PFMP Online Practice Questions and Answers

starting with the business unit you lead, which is responsible for new products, and then will set the stage to implement it throughout the bank, including at the enterprise level. You have executive support and commitment to implement it in your business unit. A key first step is to:

A. Set up a governance structure

B. Define roles and responsibilities for implementation

C. Prepare a portfolio performance plan

D. Prioritize the work to be done

After a strategic change is managed and finalized, you as a portfolio manager, are expected to document changes to the portfolio components attributes. Which of the following is the document in which you document these changes?

A. Portfolio Strategic Plan updates

B. Portfolio updates

C. Portfolio Management Plan updates

D. Portfolio Process Assets updates

Following a recent portfolio health check, you noticed that your portfolio is not aligned with the strategic plan and actions should be taken to stop losing money. What should be your next course of action?

A. Escalate to the executive management

B. Update the Strategic Plan

C. Escalate to Governance Board

D. Escalate to sponsor directly

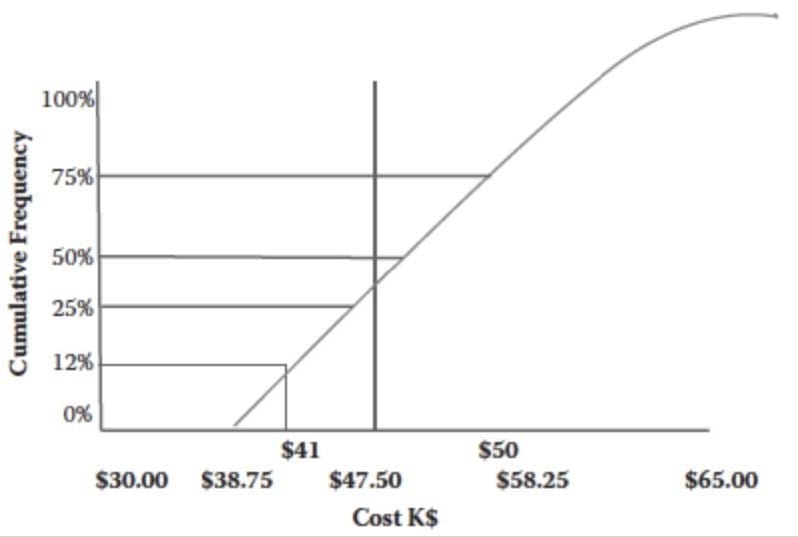

Review the following graphic. Assume now your portfolio is only 12% likely to meet is target of $41,000. Your Portfolio Review Board is dissatisfied in your management of the value of the overall portfolio. You explain the current mix of components is too risk adverse, and additional investment is required. The Board Chair then wants the needed investment to have a 75% likelihood, and you state it is:

A. $100,000

B. $50,000

C. $125,000

D. $65,000

As a portfolio manager and as part of your governance role, you use multiple tools and techniques to monitor and control the portfolio and maintain oversight. Which of the following can be used as tools and techniques in your role in oversight?

A. Review meetings, Elicitation techniques, Integration Management

B. Review meetings, Elicitation techniques

C. Review meetings, Elicitation techniques, Scenario Analysis

D. Review meetings, Elicitation techniques, PMIS

When it comes to managing a portfolio, you have a variety of assets, plans and tools and techniques used.

It requires a good experience to handle all of these artifacts. One of your portfolio team members came to

you asking about the relation between the portfolio performance management plan, the portfolio

management plan and portfolio strategic plan.

What should your answer be?

A. The portfolio strategic plan is a subsidiary plan or a component of the portfolio management plan. The portfolio performance management plan is a separate plan

B. The portfolio performance management plan is a subsidiary plan or a component of the portfolio management plan. The portfolio strategic plan is a separate plan

C. The portfolio performance management plan is a subsidiary plan or a component of the portfolio strategic plan. The portfolio strategic plan is also incorporated within the portfolio management plan as

a part of it

D. The portfolio performance management plan and the portfolio strategic plan are both subsidiaries of the portfolio management plan

As you work to determine which stakeholders had the highest degree of influence over the portfolio, you wanted to especially know about the members of the Portfolio Governance Board because:

A. They would have numerous interrelationships with other stakeholders

B. They would be best suited to work with people who were not portfolio management supporters

C. The governance processes affect information requirements

D. All of the portfolio changes, risks, and issues would be of interest to them

Different types of risks affect the portfolio, and they may be positive or negative. As the portfolio manager, one has to maximize the opportunities and minimize the threats. An example of a negative portfolio risk is:

A. External participants who are highly specialized

B. Integrated systems

C. A large number of concurrent programs and projects

D. Full-cost estimates for programs and projects

Risk management is an integral part of project, program and portfolio management and is invoked throughout the project, program and portfolio life cycle. When it comes to managing portfolio risks, which of the following activities is used

A. Risk Response

B. Risk Assessment and Risk Response

C. Risk Planning

D. Risk Assessment

Working as the portfolio manager for your business unit of a major aerospace organization means you have a variety of programs, projects, and operational activities under way. You have set up a number of reports on the progress of the portfolio for your various stakeholders, but the best approach is to monitor the progress of the portfolio against:

A. Organizational strategy

B. Organizational goals

C. Specific key performance indicators for the business unit

D. Organizational critical success factors