IMANET-CMA Online Practice Questions and Answers

Differentiated marketing covers the market by

A. Mass distribution and advertising of one offering.

B. Selling different versions of a product to multiple segments.

C. Offering different products in different segments.

D. Leveraging a communalist across multiple segments.

Strategic choices in an emerging industry are inherently subject to great uncertaintj and risk with regard to competitors, industry structure, and competitive rules. Accordingly, a firm considering entry into an emerging industry

A. Has little need to be concerned with industry cooperation.

B. Is least likely to be able to shape the industry structure at this stage.

C. May enjoy such benefits of pioneering as experience advantages and early commitment to suppliers.

D. Must be prepared for responding vigorously to competitors' moves.

If two projects are completely and positively linearly dependent (or positively related), the measure of correlation between them is

A. 0

B. + 0.5

C. +1

D. 1

The term short-selling is the

A. Selling of a security that was purchased by borrowing money from a broker.

B. Selling of a security that is not owned by the seller.

C. Selling of all the shares you own in a company in anticipation that the price will decline dramatically.

D. Betting that a stock will increase bays certain amount within a given period of time.

Cutler Publishing is considering a change in its credit terms from n/20 to 3/10, n/20. The company's budgeted sales for the coming year are $20,000,000, of which 80% are expected to be made on credit. If the new credit terms are adopted, Cutler management estimates that discounts will be taken on 60% of the credit sales; however, uncollectible accounts will be unchanged. The new credit terms will result in expected discounts taken in the coming year of

A. $288,000

B. $480,000

C. $360,000

D. $600,000

What is the weighted average cost of capital for a firm using 65% common equity with a return of 15%. 25% debt with a return of 6%. 10% preferred stock with a return of 10%. and a tax rate of 35%?

A. 10.333%

B. 11275%

C. 11325%

D. 12.250%

The frame Supply Company has just acquired a large account and needs to increase its working capital by $100,000. The controller of the company has identified the four sources of funds given below.

1.

Pay a factor to buy the company's receivable, which average $125,000 per month and have an average collection period of 30 days. The factor will advance u to 80% of the face value of receivables at 10% and charge a fee of 2%.

2.

Borrow $110,000 from a bank at 12% interest. A 9% compensating balance would be required.

3.

Issue $110,000 of 6-month commercial paper to net $100,000 (New paper would be issued every 6 months.)

4.

Borrow $125,000 from a bank on a discount basis at 20%. No compensating balance would be required. Assume a 360-day year in all of your calculations. The cost of Alternative 2. to Frame Supply Company is

A. 9.0%

B. 12.0%

C. 13.2%

D. 21.0%

The costs described in situations land IV are

A. Prime costs.

B. Sunk costs.

C. Discretionary costs.

D. Relevant costs.

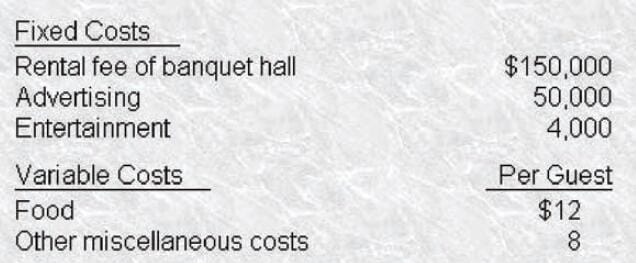

Kim is thinking of organizing a fund raiser charity. She has planned to rent a banquet hall and provide to support a local the guests with food, entertainment, and various party favors. She has decided to charge $500 a person. After researching around town, Kim has discovered the following costs:

If Kim's goal is to raise $10,000 for her charily, how many people must attend the banquet?

A. 404

B. 425

C. 428

D. 446

Lyman Company has the opportunity increase annual sales $100,000 by selling to a new. riskier group of customers The uncollectible expense is expected to be 15%, and collection costs will be 5%. The company's manufacturing and selling expenses are 70% of sales, and its effective tax rate is 40%. If Lyman should accept this opportunity. the company's after-tax profits would increase by

A. $6,000

B. $10,000

C. $10200

D. $14,400