CTP Online Practice Questions and Answers

A main characteristic of a company with regional offices using a centralized treasury function is:

A. high level of control.

B. increased borrowing costs.

C. centrally determined depository accounts.

D. increased operating costs.

Which of the following statements BEST applies when evaluating fees in an RFP for bank services?

A. Flexible credit terms are the most important consideration.

B. Ability of financial institution to customize services is critical.

C. A proforma account analysis statement captures all pricing and compensation detail.

D. Accurate evaluation and comparison of the proforma account analysis statements are critical.

The exchange of a fixed interest rate cash flow for a floating interest rate cash flow with both interest rates in the same currency is an example of:

A. a vanilla swap.

B. an interest rate option.

C. a basis-rate swap.

D. an interest rate cap.

An asset-based lender has decided to provide a loan to a company. In order to perfect its security interest in the assets used as collateral with the potential borrower, the lender will be MOST interested in reviewing which of the following?

A. Book value of inventory

B. Delinquency payment record

C. Lien search findings

D. Age of receivables

A large multinational company recently implemented new processes to automate its treasury operations. If these changes were the direct result of comparing the company's practices with those of other companies, the activities could be considered an example of which of the following?

I. Liquidating

II. Re-engineering

III. Benchmarking

IV.

Forecasting

A.

I and III only

B.

II and III only

C.

I, II, and III only

D.

I, II, and IV only

ABC Company is a net borrower with a weighted average cost of capital of 11.5%. What kind of bank fee arrangement is it likely to prefer?

A. Fee compensation

B. Balance compensation

C. Average balance compensation

D. Average fee compensation

For newly issued debt, a company's effective cost of debt is a function of yield to maturity and:

A. the credit rating of the company.

B. the marginal tax rate of the company.

C. the maturity date of the debt instrument.

D. the price of the debt instrument.

The primary bank for a major multinational company would use an overlay structure for euro zone cash concentration under which of the following circumstances?

A. The primary bank cannot provide full domestic banking services and thus must sweep surplus funds from local banks.

B. The local banks can provide full pooling arrangements and not sweep surplus funds.

C. It is cost effective for companies to provide their own in-house banking services.

D. There is excessive competition among local banks for cash management business.

A retail company is performing a risk analysis on its accepted payment types. Cash is the primary form of payment for this retailer. What is the PRIMARY issue with cash payment systems?

A. Weight of cash

B. Cost of processing

C. Security and integrity

D. Cash-based accounting practices

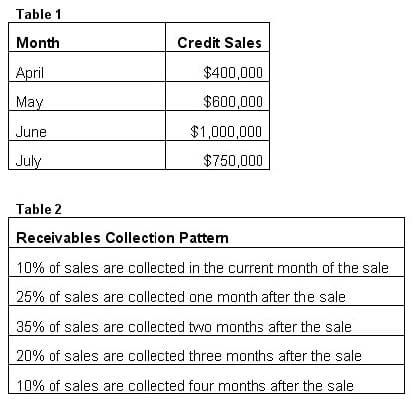

The company's monthly credit sales are in Table 1.

The company's receivables collection pattern is in Table 2. If this company's accounts receivable on March 31 is $0, what would the accounts receivable balance be at the end of July? Assume a 90-day quarter.

A. $845,000

B. $1,205,000

C. $1,545,000

D. $1,580,000