CPA-TEST Online Practice Questions and Answers

An accountant's report on a review of pro forma financial information should include a: A. Statement that the entity's internal control was not relied on in the review.

B. Disclaimer of opinion on the financial statements from which the pro forma financial information is derived.

C. Caveat that it is uncertain whether the transaction or event reflected in the pro forma financial information will ever occur.

D. Reference to the financial statements from which the historical financial information is derived.

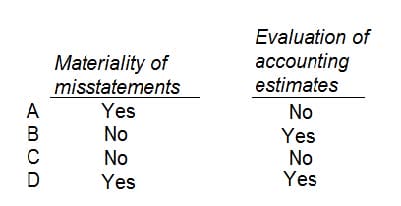

For which of the following judgments may an independent auditor share responsibility with an entity's internal auditor who is assessed to be both competent and objective?

A. Option A

B. Option B

C. Option C

D. Option D

Symbol B most likely represents:

A. Customer orders.

B. Receiving reports.

C. Customer checks.

D. Sales invoices.

A report on a nonissuer's internal control should include a statement limiting the use of the report when:

A. Management's assertion is presented in a separate report that will accompany the CPA's report.

B. Management's assertion is presented as a representation letter to the CPA.

C. Management's assertion is presented based upon criteria that are available to specific parties.

D. Management's assertion is not presented.

Because of the pervasive effects of laws and regulations on the financial statements of governmental units, an auditor should obtain written management representations acknowledging that management has:

A. Identified and disclosed all laws and regulations that have a direct and material effect on its financial statements.

B. Implemented internal controls designed to detect all illegal acts.

C. Expressed both positive and negative assurance to the auditor that the entity complied with all laws and regulations.

D. Employed internal auditors who can report their findings, opinions, and conclusions objectively without fear of political repercussion.

In 1992, Anchor, Chain, and Hook created ABC Associates, a general partnership. The partners orally agreed that they would work full time for the partnership and would distribute profits based on their capital contributions. Anchor contributed $5,000; Chain $10,000; and Hook $15,000. For the year ended December 31, 1993, ABC Associates had profits of $60,000 that were distributed to the partners. During

1994, ABC Associates was operating at a loss. In September 1994, the partnership dissolved.

In October 1994, Hook contracted in writing with XYZ Co. to purchase a car for the partnership. Hook had

previously purchased cars from XYZ Co. for use by ABC Associates partners. ABC Associates did not

honor the contract with XYZ Co., and XYZ Co. sued the partnership and the individual partners.

A. XYZ Co. would lose a suit brought against ABC Associates because Hook, as a general partner, has no authority to bind the partnership.

B. XYZ Co. would win a suit brought against ABC Associates because Hook's authority continues during dissolution..

A characteristic of the payback method (before taxes) is that it:

A. Incorporates the time value of money.

B. Neglects total project profitability.

C. Uses accrual accounting inflows in the numerator of the calculation.

D. Uses the estimated expected life of the asset in the denominator of the calculation.

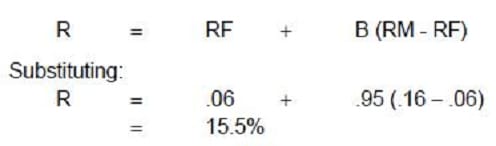

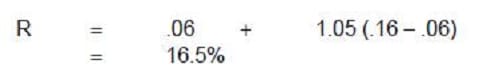

ABC Industries, which has no current debt, has a beta of .95 for its common stock. Management is considering a change in the capital structure to 30% debt and 70% equity. This change would increase the beta on the stock to 1.05, and the after-tax cost of debt will be 7.5%. The expected return on equity is 16%, and the risk-free rate is 6%. Should ABC's management proceed with the capital structure change?

A. No, because the cost of equity capital will increase.

B. Yes, because the cost of equity capital will decrease.

C. Yes, because the weighted average cost of capital will decrease.

D. No, because the weighted average cost of capital will increase.

Which one of the following would not be considered a carrying cost associated with inventory?

A. Insurance costs.

B. Cost of capital invested in the inventory.

C. Cost of obsolescence.

D. Shipping costs.

Which of the following statements is the best definition of real property?

A. Real property is only land.

B. Real property is all tangible property including land.

C. Real property is land and intangible property in realized form.

D. Real property is land and everything permanently attached to it.