CPA-REGULATION Online Practice Questions and Answers

Which payment(s) is(are) included in a recipient's gross income?

I. Payment to a graduate assistant for a part-time teaching assignment at a university. Teaching is not a requirement toward obtaining the degree.

II.

A grant to a Ph.D. candidate for his participation in a university-sponsored research project for the benefit of the university.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

On December 1, 1992, Michaels, a self-employed cash basis taxpayer, borrowed $100,000 to use in her business. The loan was to be repaid on November 30, 1993. Michaels paid the entire interest of $12,000 on December 1, 1992. What amount of interest was deductible on Michaels' 1993 income tax return?

A. $12,000

B. $11,000

C. $1,000

D. $0

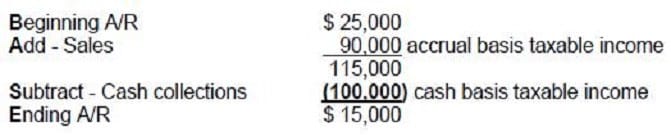

Mosh, a sole proprietor, uses the cash basis of accounting. At the beginning of the current year, accounts receivable were $25,000. During the year, Mosh collected $100,000 from customers. At the end of the year, accounts receivable were $15,000. What was Mosh's gross taxable income for the current year?

A. $75,000

B. $90,000

C. $100,000

D. $110,000

Which one of the following will result in an accruable expense for an accrual-basis taxpayer?

A. An invoice dated prior to year end but the repair completed after year end.

B. A repair completed prior to year end but not invoiced.

C. A repair completed prior to year end and paid upon completion.

D. A signed contract for repair work to be done and the work is to be completed at a later date.

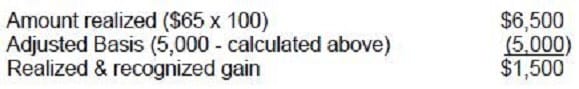

Greller owns 100 shares of Arden Corp., a publicly-traded company, which Greller purchased on January 1, 2001, for $10,000. On January 1, 2003, Arden declared a 2-for-1 stock split when the fair market value (FMV) of the stock was $120 per share. Immediately following the split, the FMV of Arden stock was $62 per share. On February 1, 2003, Greller had his broker specifically sell the 100 shares of Arden stock received in the split when the FMV of the stock was $65 per share. What is the basis of the 100 shares of Arden sold?

A. $5,000

B. $6,000

C. $6,200

D. $6,500

Allen owns 100 shares of Prime Corp., a publicly-traded company, which Allen purchased on January 1, 2001, for $10,000. On January 1, 2003, Prime declared a 2-for-1 stock split when the fair market value (FMV) of the stock was $120 per share. Immediately following the split, the FMV of Prime stock was $62 per share. On February 1, 2003, Allen had his broker specifically sell the 100 shares of Prime stock received in the split when the FMV of the stock was $65 per share. What amount should Allen recognize as long-term capital gain income on his Form 1040, U.S. Individual Income Tax Return, for 2003?

A. $300

B. $750

C. $1,500 D. $2,000

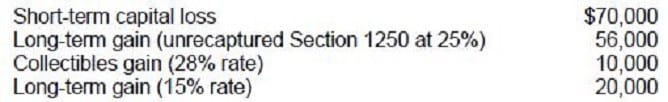

An individual had the following capital gains and losses for the year:

What will be the net gain (loss) reported by the individual and at what applicable tax rate(s)?

A. Long-term gain of $16,000 at the 15% rate.

B. Short-term loss of $3,000 at the ordinary rate and long-term capital gain of $86,000 at the 15% rate.

C. Long-term capital gain of $3,000 at the 15% rate, collectibles gain of $10,000 at the 28% rate, and Section 1250 gain of $56,000 at the 25% rate.

D. Short-term loss of $3,000 at the ordinary rate, long-term capital gain of $10,000 at the 15% rate, collectibles gain of $10,000 at the 28% rate, and Section 1250 gain of $56,000 at the 25% rate.

For a cash basis taxpayer, gain or loss on a year-end sale of listed stock arises on the:

A. Trade date.

B. Settlement date.

C. Date of receipt of cash proceeds.

D. Date of delivery of stock certificate.

Among which of the following related parties are losses from sales and exchanges not recognized for tax purposes?

A. Father-in-law and son-in-law.

B. Brother-in-law and sister-in-law.

C. Grandfather and granddaughter.

D. Ancestors, lineal descendants, and all in-laws.

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040. During 1994, the Moores received a $2,500 federal tax refund and a $1,250 state tax refund for 1993 overpayments. In 1993, the Moores were not subject to the alternative minimum tax and were not entitled to any credit against income tax. The Moores' 1993 adjusted gross income was $80,000 and itemized deductions were $1,450 in excess of the standard deduction. The state tax deduction for 1993 was $2,000.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000

K. $10,000

L. $25,000

M. $50,000

N. $55,000

O. $75,000