CMA Online Practice Questions and Answers

Which relationship marketing level is appropriate for a low unit profit margin and many customers?

A. Reactive marketing.

B. Basic marketing.

C. Partnership marketing.

D. Proactive marketing.

The high cost of short--term financing has recently caused a company to reevaluate the terms of credit it extends to its customers. The current policy is 11101 net 60. If customers can borrow at the prime rate, at what prime rate must the company change its terms of credit in order to avoid an undesirable extension in its collection of receivables?

A. 2%

B. 5%

C. 7%

D. 8%

Which one of the following financial instruments generally provides the largest source of short-term credit for small firms?

A. Installment loans.

B. Commercial paper.

C. Trade credit.

D. Bankers' acceptances.

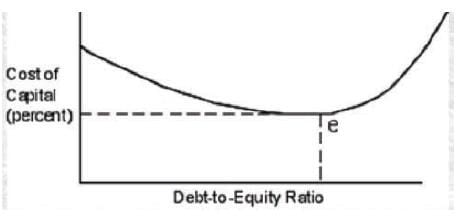

In referring to the graph of a firm's cost of capital, if e is the current position, which one of the following statements best explains the saucer or U-shaped curve'?

A. The composition of debt and equity does not affect the firm's cost of capital.

B. The cost of capital is almost always favorably influenced by increases in financial leverage.

C. The cost of capital is almost always negatively influenced by increases in financial leverage.

D. Use of at least some debt financing will enhance the value of the firm.

Rational decision making is a multistep process. In which stage of this process will effective communication to persons affected by the decision be most important?

A. Evaluating possible solutions.

B. Defining the problem.

C. Following up.

D. Gathering relevant information.

A financial manager usually prefers to issue preferred stock rather than debt because

A. Payments to preferred stockholders are not considered fixed payments

B. The cost of fixed debt is less expensive since it is tax deductible even if a sinking fund is required to retire the debt.

C. The preferred dividend is often cumulative, whereas interest payments are not.

D. In a legal sense, preferred stock is equity, therefore, dividend payments are not legal obligations

Commercial paper

A. Has a maturity date greater than 1 year.

B. Is usually sold only through investment banking dealers.

C. Ordinarily does not have an active secondary market

D. Has an interest rate lower than Treasury bills.

The one item listed below that would warrant the least amount of consideration in credit and collection policy decisions is the

A. Quality of accounts accepted.

B. Quantity discount given.

C. Cash discount given.

D. Level of collection expenditures.

Unit fixed costs

A. Are constant per unit regardless of units produced or sold.

B. Are determined by dividing total fixed costs by a denominator such as production or sales volume.

C. Vary directly with the activity level when stated on a per-unit basis.

D. Include both fixed and variable elements.