CIMAPRO19-P02-1 Online Practice Questions and Answers

To which technique for dealing with risk and uncertainty do ALL of the following statements apply?

It requires that only one factor is considered at a time.

It identifies areas which are crucial to a project, which can then be monitored if the project is chosen.

It does not provide an indication of the likelihood of any change in the factors.

Following the calculation, it requires the exercising of judgement to decide whether to accept or reject a project.

A. Sensitivity analysis

B. Probability analysis

C. Scenario analysis

D. Adjusting the discount rate to reflect risk.

A company must decide today whether to proceed with a proposed project. If the project proceeds, the initial investment of $150,000 would be made in one year's time. The benefit of the project would be a perpetuity of $22,000 per year

commencing one year after the investment is made. The company's cost of capital is 14% per year.

To the nearest $100, what is the net present value of the project?

A. $6,300

B. $7,100

C. -$12,200

D. $25,600

Which of the following is a key objective when agreeing a basis for setting transfer prices?

A. Promoting goal congruence

B. Increasing market share

C. Rewarding profit centre managers

D. Allocating overhead costs effectively

Performance measures that monitor the extent to which a not-for-profit organization's objectives have been achieved are measures of:

A. economy

B. efficiency

C. effectiveness

D. enterprise

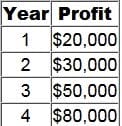

A project requires an initial investment of $160,000 in an asset for which the annual depreciation charge will be $40,000. The forecast profits from the investment are as follows.

What is the payback period for the project in years? Give your answer to two decimal places.

A. 2.33 years

Which basis of transfer pricing retains the full autonomy of divisional managers?

A. Full cost-plus pricing

B. Variable cost-plus pricing

C. Negotiated pricing

D. Market based pricing

A positive net present value (NPV) has been calculated for a project to launch a new product. An additional calculation is required to identify the sensitivity of the NPV to changes in the forecast total sales volume. The present value of which of the following would be used in the calculation?

A. Contribution

B. Operating profit

C. Fixed overheads

D. Net profit

The management of a leisure company, who are risk averse, have just approved an investment in a new amusement park. The country in which the amusement park will be located has a warm and mostly dry climate throughout the year. A number of specific risks related to this investment have been identified as follows.

(1)

Losses of very small amounts of revenue due to poor weather.

(2)

A significant financial liability may arise due to the injury of a member of the public.

(3)

Loss of several days of revenue due to rides being unavailable because of poor maintenance routines.

(4)

Income fraud as a consequence of the high levels of cash handled by employees.

Using the TARA framework, which is the most appropriate way of managing each of these risks?

A. Transfer risk 1; accept risk 2; avoid risk 3; reduce risk 4

B. Accept risk 1; avoid risk 2; transfer risk 3; reduce risk 4

C. Accept risk 1; transfer risk 2; avoid risk 3; reduce risk 4

D. Reduce risk 1; transfer risk 2; avoid risk 3; accept risk 4

SDF makes cars. Demand for one of SDF's most popular models has declined because of a long- running television program. SDF's car is driven by a villainous character in the program and that has created such a negative association that

sales have declined so significantly that SDF is planning to discontinue production.

Which of the following statements is correct? Select ALL that apply.

A. Business risks can arise from unexpected events.

B. The use of a product in a television program can create upside risks.

C. SDF should have considered the possibility that sales of this car could be affected by public perception, even though the car's practical attributes are unchanged.

D. SDF's board should accept full responsibility for permitting this to happen.

E. SDF's sales department should have prevented the television production company from buying the car.

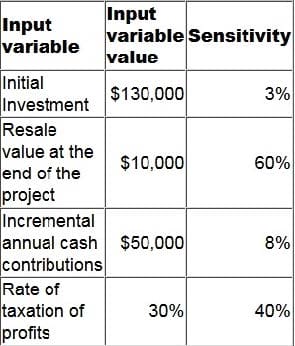

A project is viable because it has a positive net present value (NPV). Details of four of the input variables, together with the sensitivity of the viability of the project to a change in each one in isolation, are given below.

Which of the following statements is correct?

A. A 1% change in the initial investment will result in a change of 3% in the NPV.

B. The resale value at the end of the project is the most sensitive of the four variables.

C. If the incremental annual cash contributions reduce by more than 8% then the project will no longer be viable.

D. If the rate of taxation on profits increases to 40% then the project will no longer be viable.