CIMAPRO17-BA2-X1-ENG Online Practice Questions and Answers

FILL BLANK

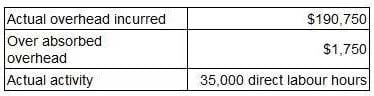

A company absorbs production overhead using a direct labour hour rate. Data for the latest period are as follows:

What is the overhead absorption rate per direct labour hour? Give your answer to one decimal place.

A. 5.4

Which of the following is a valid definition of a cash budget?

A. A detailed budget of estimated cash inflows and outflows incorporating both revenue and capital items.

B. A detailed budget of estimated cash inflows only, incorporating receipts from cash sales as well as from credit customers.

C. A detailed budget of estimated cash inflows and outflows incorporating revenue items only.

D. A detailed budget of estimated cash outflows only, incorporating both depreciation and capital expenditure.

Based upon extensive historical evidence, a company's daily sales volume is known to be normally distributed with a mean of 1,728 units and a standard deviation of 273 units. What is the probability that, on any one day, the sales volume will be at least 1,300 units?

A. 5.82%

B. 73.89%

C. 44.18%

D. 94.18%

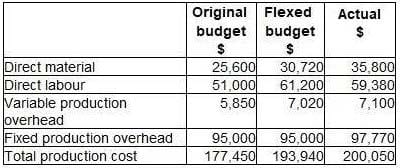

The following is an extract from a budgetary control report for the latest period:

The budget variance for prime cost is:

A. $3,260 adverse

B. $18,580 adverse

C. $3,340 adverse

D. $3,260 favourable

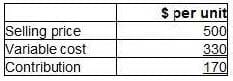

A confectionery manufacturer is considering adding a new product to the current range. Forecast data for the product are as follows.

Incremental fixed costs attributable to the new product are forecast to be $24,000 each period.

The forecast sales volume of 180 units is insufficient to achieve the target profit of $10,000 each period.

Which of the following statements is correct?

A. The margin of safety is negative because the target profit will not be achieved from the forecast sales volume.

B. If the fixed cost is changed to $20,000 the sales volume required to break even will decrease.

C. If the forecast sales volume is changed to 190 units the sales volume required to achieve the target profit will decrease.

D. If the selling price is changed to $510 the sales volume required to achieve the target profit will increase.

The concept of the time value of money:

A. recognises the fact that a cash flow received today will always be worth more than a larger cash flow received in the future.

B. is used for making short term decisions.

C. determines the higher interest rates that must be paid on longer term loans.

D. recognises the fact that earlier cash flows are worth more because they can be reinvested.

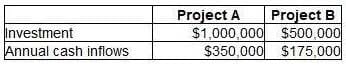

A company is appraising two projects. Both projects are for five years. Details of the two projects are as follows.

Based on the above information, which of the following statements is correct?

A. An annuity could be used to calculate the net present value of the projects.

B. The annuity factor for project A would be lower than the annuity factor for the project B.

C. A perpetuity could be used to calculate the net present value of the projects.

D. The annuity factor for project A would double the annuity factor for project B.

Which THREE of the following are included in the Global Management Accounting Principles? (Choose three.)

A. Accountability

B. Influence

C. Value

D. Professional behaviour

E. Relevance

F. Integrity

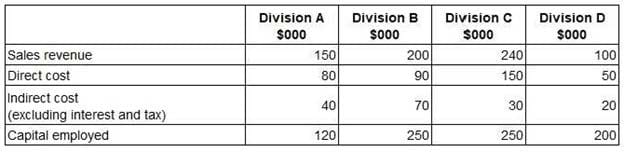

An organisation's management report contains the following data:

Which division has the highest operating margin percentage?

A. Division A

B. Division B

C. Division C

D. Division D

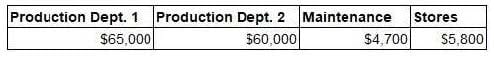

A company has two production departments and two service departments (Maintenance and Stores). The overhead costs of each of the departments are as follows.

The following equations represent the reapportionment of each of the service department overheads to the other.

M = 4,700 + 0.1S S = 5,800 + 0.2M

Where M = total Maintenance overhead after reapportionment from Stores S = total Stores overhead after reapportionment from Maintenance 60% of the total Maintenance overhead and 50% of the total Stores overhead are to be apportioned to Production Department 1.

The total production overhead for Production Department 1 after reapportionment of the service departments' overhead costs is closest to:

A. $71,672

B. $75,500

C. $70,720

D. $71,821