CAMS-FCI Online Practice Questions and Answers

An unusual spike in activity has occurred for a customer who is a supplier of aviation parts to a military force. The customer's current line of business is consistent with the banks records, and no adverse media hits have occurred. Which is the best reason for an investigator to continue an investigation?

A. The end-user is a military force.

B. There are no adverse media hits.

C. The customer is a supplier of aviation parts.

D. The current line of business is consistent with the bank's records.

A financial institution

A. A customer makes several deposits in one month that appear to exceed their expected monthly income.

B. A customer receives a large, one-time wire from a law firm.

C. The Fl is unable to obtain evidence of required licensing or registration despite suspicion of money transmitting.

D. The Fl discovers a large number of securities transactions that appear to be related to day trading.

A country that does not have strong predicate offenses and is lax in prosecuting AML cases could suffer which social/economic consequence?

A. US sanctions

B. Increased organized crime and corruption

C. Reputation risk for the port

D. Loss of tax revenue

A bank investigator notices an account receiving multiple deposits from the same employer under different employees' names. A cash withdrawal occurs one day after each deposit. The outcome of this investigation will likely uncover which crime typology?

A. Human trafficking

B. Environmental

C. Trade-based money laundering

D. Bribery and corruption

In the past 6 months, a small financial institution (Fl) has received regular remittances that are increasing in value from a country with high piracy activity. The Fl's AML officer (AMLO) has also noted that piracy in this country has increased in the same time frame. Which recommendation should the AMLO make?

A. Request the operations department to return inbound remittances when the sender of funds is from this country.

B. Upgrade the transaction monitoring system of the Fl to include more fields so that more in-depth information is collected about the inward remittances.

C. File a SAR/STR to the appropriate AML authority immediately.

D. Conduct an in-depth investigation into accumulated remittance information in the past year to find the trend of such transactions.

CLIENT INFORMATION FORM Client Name: ABC Tech Corp Client I.D. Number: 08125 Name: ABC Tech Corp Registered Address: Mumbai, India Work Address: Mumbai. India Cell Phone: **?quot;-- Alt Phone: Email: *?? *?

Client Profile Information:

Sector: Financial

Engaged in business from (date): 02 Jan 2020

Sub-sector: Software-Cryptocurrency Exchange

Expected Annual Transaction Amount: 125.000 USD

Payment Nature: Transfer received from client's fund

Received from: Clients

Received for: Sale of digital assets

The client identified themselves as "Cryptocurrency Exchange" Client has submitted the limited liability partnership deed. However, the bank's auditing team is unable to identify the client's exact business profile as the cryptocurrency exchange specified by the client as their major business awaits clearance from the country's regulator. The client has submitted documents/communications exchanged with the regulator and has cited the lack of governing laws in the country of their operation as the reason for the delay.

Investigators determine the ultimate beneficial owner of ABC Tech Corp is a high-net-worth client. The client owns a real estate agency left to her when her spouse died. The spouse provided seed capital for ABC Tech Corp through a direct 1,000.000 Great British Pound (GBP) deposit.

What additional information would trigger filing a SAR/STR?

A. The client's spouse's source of wealth was a salary of 250,000 GBP per annum for the past 4 years and rental of properties of 150,000 GBP per annum for the past 6 years.

B. The client's current net asset value is 8 million GBP, of which 7.5 million GBP was derived from the inheritance.

C. An open-source search revealed that the client's spouse was a PEP.

D. The funds for the seed capital were in the form of 50 cashier's checks of 10,000 GBP each and 50 money orders of 10,000 GBP.

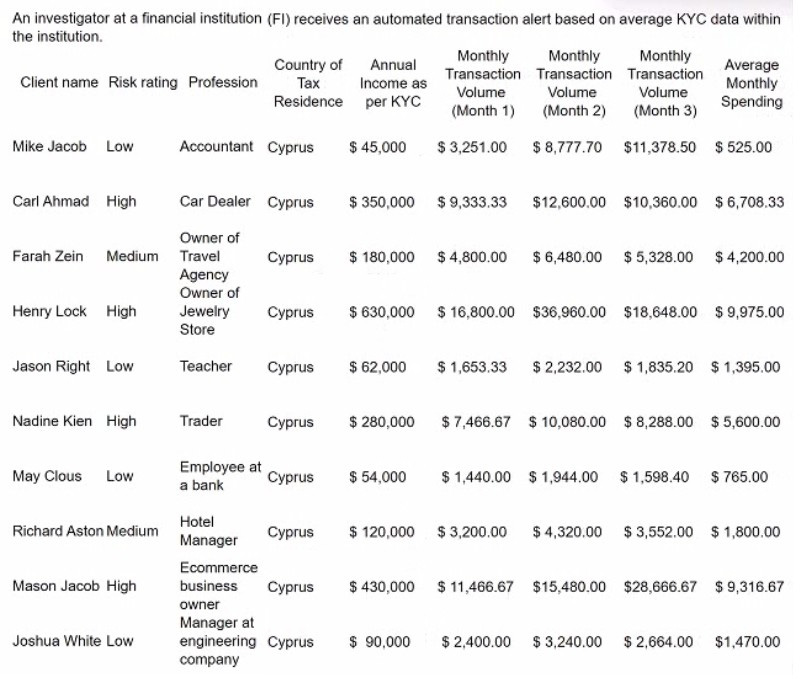

During a review of the accounts related to Richard Aston, an investigator notices a high number of incoming payments from various individuals.

They also notice that these incoming payments typically occur during large sporting events or conferences. As a result of the account review, of which illegal activity does the investigator have reasonable grounds to suspect Richard Aston?

A. Embezzling from the hotel

B. Aftermarket sales of entertainment admission tickets

C. Human trafficking

D. Sports betting

How does the Asian/Pacific Financial Action Task Force

A. Promotes laws that allow judicial challenges to seizure orders by an administrative body

B. Endorses regulations that define money laundering based on the model laws issued by the respective member states

C. Facilitates the adoption and implementation of internationally accepted AMI measures by member jurisdictions

D. Encourages cooperative AML efforts in the region

E. Requires members to maintain lists of regional money laundering and terrorists financing issues relevant to their region

Law enforcement (LE) suspects human trafficking to occur during a major sporting event. LE officers asked several financial institutions (FIs) to monitor financial transactions occurring before, during, and after the event.

An investigator identified a pattern linked to a business. The business' account received multiple even dollar deposits between midnight and 4:00 AM. They occurred each day for several days prior to the date of the sporting event. Also, large

cash deposits, typically between 2,000 USD and 3,000 USD. made by a person to the business' account occurred in many branches in the days after the sports event.

There was little information about the company. The company did not have any history of employee payroll expenses or paying taxes. Expenses from the business account included air travel and hotel expenses. Searches about the person

making cash deposits showed little. An online social media platform webpage with the individual's name showed ads for dates" and "companionship."

The Fl receives a keep open' letter from LE for the identified account and agrees to keep the account open. What is the Fl required to do?

A. Contact the client for information relating to the account.

B. Stop filing SAR/STR reports on the account and/or customer.

C. Ensure that the request includes an end date.

D. Notify LE immediately after new transactions.

An analyst reviews an alert for high volume Automated Clearing House (ACH) activity in an account. The analyst's initial research finds the account is for a commercial daycare account that receives high volumes of large government-funded ACH transactions to support the programs. The account activity consists of checks (cheques) made payable to individual names in varying dollar amounts. One check indicates rent to another business.

An Internet search finds that the daycare company owner has previous government-issued violations for safety and classroom size needs, such as not having enough chairs and tables per enrollee. These violations were issued to a different daycare name.

Simultaneous to this investigation, another analyst sends an email about negative news articles referencing local child/adult daycare companies misusing governmental grants. This prompts the financial institution (Fl) to search all businesses for names containing daycare' or care*. Text searches return a number of facilities as customers at the Fl and detects that three of these businesses have a similar transaction flow of high volume government ACH funding with little to no daycare expenses.

The analyst determines that site visits should be conducted for the three daycare businesses. Which observations at the on-site visits would justify writing a SAR/STR? (Select Three.)

A. Signs of severe wear and poor maintenance at the site

B. A site located in a commercial building

C. Lights turned off at the site during operational hours

D. Visible attendance with children being dropped off by parents

E. Visible signage indicating the purpose of the building

F. A full parking lot of cars with no staff at the site