BUSINESS-ENVIRONMENT-AND-CONCEPTS Online Practice Questions and Answers

What term is used to describe a partnership without a specified duration?

A. A perpetual partnership.

B. A partnership by estoppel.

C. An indefinite partnership.

D. A partnership at will.

Aarons Group, Limited Partnership, was formed by three brothers, Aaron, Barry, and Sam. Aaron is the general partner and devotes more than 60 hours per week to the business. Barry and Sam are limited partners who work for different companies having no relationship to the limited partnership. The partners' capital contributions are as follows: Aaron invested 20%. Barry and Sam invested 40% each. During the formation of the limited partnership, the brothers signed an agreement that addresses how the brothers will split profits and losses. At year-end, the limited partnership enjoyed large profits due to high demand for the business' product line. The profits will be divided:

A. In proportion to each partner's capital contribution.

B. According to the agreement.

C. Equally.

D. By determining by the amount of time and labor each partner devoted to the operation of the partnership.

Which of the following actions is required to ensure the validity of a contract between a corporation and a director of the corporation?

A. An independent appraiser must render to the board of directors a fairness opinion on the contract.

B. The director must disclose the interest to the independent members of the board and refrain from voting.

C. The shareholders must review and ratify the contract.

D. The director must resign from the board of directors.

Acorn and Bean were general partners in a farm machinery business. Acorn contracted, on behalf of the partnership, to purchase 10 tractors from Cobb Corp. Unknown to Cobb, Acorn was not authorized by the partnership agreement to make such contracts. Bean refused to allow the partnership to accept delivery of the tractors and Cobb sought to enforce the contract. Cobb will:

A. Lose because Acorn's action was beyond the scope of Acorn's implied authority.

B. Prevail because Acorn had implied authority to bind the partnership.

C. Prevail because Acorn had apparent authority to bind the partnership.

D. Lose because Acorn's express authority was restricted, in writing, by the partnership agreement.

Economic theory identifies two basic types of goods: inferior goods and superior goods. As consumer income rises, a lower percentage of earnings are expended on inferior goods while a higher percentage of earnings are spent on superior goods. Overall strategies for achieving organizational missions would most likely match with types of goods as follows:

A. Cost leadership strategies for superior goods, differentiation strategies for inferior goods.

B. Cost leadership strategies for inferior goods, differentiation strategies for superior goods.

C. Cost leadership strategies would most likely be used for both inferior and superior goods.

D. Differentiation strategies would most likely be used for both inferior and superior goods.

An example of an indirect cash flow effect would be:

A. Cash committed at inception of the project.

B. Increased payroll expenses due to the project.

C. A depreciation tax shield.

D. An increase in expected future operating cash flows.

The net present value (NPV) of a project has been calculated to be $215,000. Which one of the following changes in assumptions would decrease the NPV?

A. Decrease the estimated effective income tax rate.

B. Extend the project life and associated cash inflows.

C. Increase the estimated salvage value.

D. Increase the discount rate.

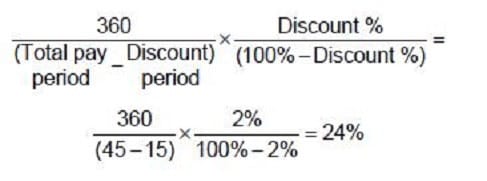

If a firm's credit terms require payment within 45 days but allow a discount of 2 percent if paid within 15 days (using a 360 day year), the approximate cost/benefit of the trade credit terms is:

A. 16 percent.

B. 48 percent.

C. 24 percent.

D. 36 percent.

Which one of the following would not be considered a carrying cost associated with inventory?

A. Insurance costs.

B. Cost of capital invested in the inventory.

C. Cost of obsolescence.

D. Shipping costs.

CyberAge outlet, a relatively new store, is a cafe that offers customers the opportunity to browse the Internet or play computer games at their tables while they drink coffee. The customer pays a fee based on the amount of time spent signed on to the computer. The store also sells books, tee shirts, and computer accessories. CyberAge has been paying all of its bills on the last day of the payment period, thus forfeiting all supplier discounts. Shown below are data on CyberAge's two major vendors, including average monthly purchases and credit terms.

Should CyberAge use trade credit and continue paying at the end of the credit period?

A. No, if the cost of alternative short-term financing is more.

B. Yes, if the firm's weighted average cost of capital is equal to its weighted average trade credit.

C. No, if the cost of alternative long-term financing is more.

D. Yes, if the cost of alternative short-term financing is more.