1Z0-1060-22 Online Practice Questions and Answers

Where do you define the currency conversion type to be used in converting accounted amount for reporting currency ledger?

A. Specify Ledger Options

B. Manage Accounting Attribute Assignments

C. Manage Reporting Currencies

D. Manage Subledger Accounting Options

Given the business use case:

'New Trucks' runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company 'Fix Trucks' that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, 'New Trucks' needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

What would the typical line information be?

A. Customer Number

B. Truck Type

C. Company

D. Transaction Date

'Insurances for Homes' company provide home insurance service. They have in-house built system that processes home insurance payments received from customers. The end result of the process consists of a listing of individual journal entries in a spreadsheet. They have requirements for getting all journal entries in a secure and auditable repository. Access will be limited to selective staff members. Additionally, be able to report and view the entries using an advanced reporting and analytical tools for slicing and dicing the Journal entries.

Which is a correct example for a formula to prorate amounts evenly across each period? Note that the NumberofGLPeriod is a predefined function that returns the number of non adjustment accounting periods between two dates.

A. "Amount" *( NumberofGLPeriod ("Effective Date", "Last Day of Current Accounting Period") + 1)/ (NumberofGLPeriod ("Effective Date", "Expiiy Date") + 1)

B. "Amount" - ("Last Day of Current Accounting Period" - "Effective Date" ) / ("Expiry Date" -"Effective Date")

C. "Amount" * ("Last Day ol Current Accounting Period" - "Effective Date" + 1) / (("Expiry Date" "Effective Date") + 1)

D. "Amount" * NumberofGLPeriod ("Effective Date", "Last Day of Current Accounting Period") / NumberofGLPeriod ("Effective Date", 'Expiry Date")

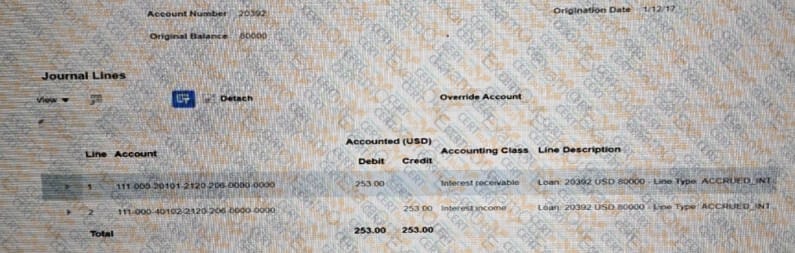

Given the journal: What is the terminology that is used to identify the "Account Number', 'Original Balance' , and 'Origination Date' fields?

A. User Transaction Identifier

B. Attribute Identifier

C. Source System Identifier

D. System Identifier

Which is used to track a specific transaction attribute on subledger journal entries?

A. value set rules

B. lookup value rules

C. supporting references

D. account rules

What feature is NOT provided by Fusion Accounting Hub Reporting Cloud Service (FAHRC)?

A. transfer Balances to FAH Reporting Cloud Service

B. synchronize setup data from Oracle R12 E-Business Suite to FAH Reporting Cloud Service

C. upload transaction data into FAH Reporting Cloud Service

D. provide real-time visibility to financial reports in FAH Reporting Cloud Service

Given the business use case:

'Insurances for Homes' company provides home insurance services. They have an in-house built system that processes insurance payments received from customers. The end result of the process consists of a listing of individual journal entries in a spreadsheet. They have requirements for getting all Journal entries in a secure and auditable repository. Access will be limited to selective staff members. Additionally, the company need to be able to report and view the entries using advanced reporting and analytical tools for segmenting, viewing and understanding data in the journal entries.

The line information may contain more than one line for the same header.

When uploading transactions, which is a way to differentiate each Journal line?

A. Assign a custom formula.

B. Assign an accounting attribute.

C. You do not need to do anything additional.

D. Assign a line classification or line type attribute.

You are explaining to an accountant that account override is an adjustment feature of Subledger Accounting.

Which two traits can help you explain this feature?

A. The account override feature provides an audit trail by preserving the original subledger journal entry.

B. The account override feature adjusts the original source transaction.

C. The account override feature is only intended to correct subledger journals that have been posted.

D. The account override feature allows users to record a reason for the adjustment.

Given the business use case:

'New Trucks' runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company 'Fix Trucks' that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, 'New Trucks' needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

How can the automatic recognition of insurance income be implemented in Accounting Hub Cloud?

A. Set up multiperiod accounting journal lines.

B. Set up a transaction line reversal.

C. Create an adjustment journal entry.

D. Set up automatic Journal line reversal.

What is NOT included in the minimum required accounting attribute assignments?

A. Second Distribution Identifier

B. First Distribution Identifier

C. Distribution Type

D. Accounting Date