1Z0-1059-22 Online Practice Questions and Answers

The Contracts Requiring Attention user Interface has three tabs: Pending Review, Pending Allocation, and Pending Revenue Recognition.

What would cause a contract to be In the Pending Reviewtab?

A. The total Transaction Price is over the user-defined threshold amount.

B. The contract is missing standalone selling prices at the promised detail level or at obligation level.

C. The contract is missing satisfaction events.

D. The contract ismissing Billing data.

At which level does Oracle Revenue management perform accounting?

A. Legal entity level

B. Contract level

C. Performance obligation level

What is a contract modification?

A. a change to the contract caused by negotiation with the customer

B. a revision or correction to the estimate of variable consideration made at inception

C. a change (modification) to the contract data

D. an increase or decrease inexpected collectability

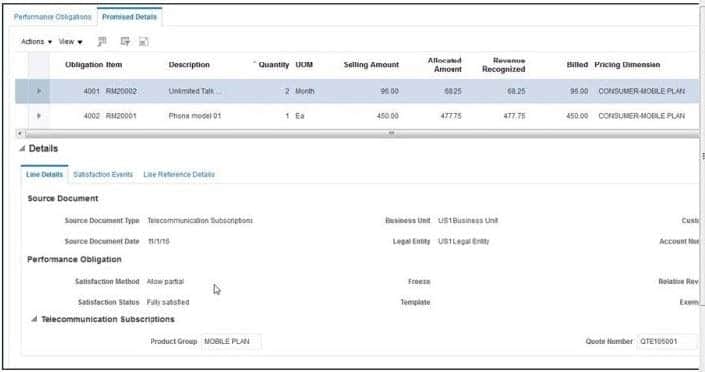

The contract Promised Details tabs includes Selling Amount, Allocated Amount, RevenueRecognized, and Bill.......

What is the difference between Selling Amount and Allocated Amount?

A. The Selling Amount is calculated based on Standalone Selling Prices and is used for the Revenue Recognition amount. The Allocated Amount is based on the source document sales lines amounts and is ultimately used to tie back to your source document upload.

B. The Selling Amount is calculated based on the source document sales lines amounts and is used to tie back to your source document upload. The Allocated Amount is based on Standalone Selling Price and is ultimately used for the Revenue Recognition amount.

C. The Selling Amount is calculated based on Standalone Selling Prices and is used to tie back to your SSP upload or calculation. The Allocated Amount is based on the Billed amount and is ultimately used for the Revenue Recognition amount.

D. The Selling Amount is calculated based on the source document sales lines amount and is used for the Revenue Recognition amount. The Allocated Amount is based on the Billed Amount and Is used to tie back to your Billing source document upload.

Which is NOT a predefined Accounting Class for Revenue Management?

A. Contract Discount

B. Contract Liability

C. Contract Unearned Revenue

D. Contract Asset

You have defined 3 Contract Identification rules: Rule A, Rule B, and Rule C. You then decide that Rule C needs to be the first rule executed when the "Identify Customer Contracts" processruns. Which attribute needs to be updated to achieve this objective?

A. Freeze Period

B. Default Classification

C. Source Document Type

D. Priority

Revenue tracks several amounts associated to a customer contract, for example, selling amount, allocated amount, and billed amount.What is allocated amount?

A. stand-alone selling price assigned to the promised detail line

B. transaction price distributed to each performance obligation

C. transaction price derived from the source system line import

D. revenue recognized for each performance obligation

Which three statements about Effective Periods are true?

A. If effective periods are not defined. Revenue Management uses the General Ledger calendar.

B. Effective Periods are used for standalone selling prices and for creating journal entries.

C. Gaps between periods are not allowed.

D. You cannot have overlapping periods.

E. Effective Periods only define the rage where standalone selling prices ofan item should be effective.

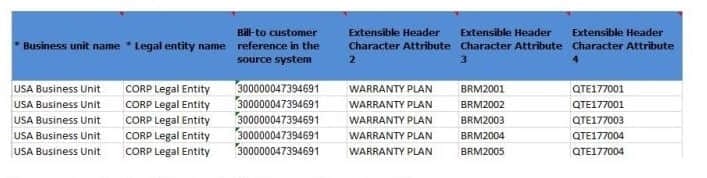

You define a Contract Identification Rule that uses the following source document attributes to match transaction lines: Bill-to Customer Party Identifier Extensible Header CharacterAttribute 4 Based the data displayed:

How many contracts will be created In Revenue Management?

A. 3

B. 1

C. 5

D. 0

E. 4

What are two major changes when comparing the new revenue recognition guidance under ASC 606 and IFRS 15 versus the old standard?

A. Revenue and performance obligation liabilities are not dependent on billing.

B. Revenue can be recognized for performance obligations only using the "Point in Time" approach.

C. Pricing estimates cannot be used In the absence of pricing data.

D. Expected consideration value is applicable to all industries.